As Shop Car Insurance Quotes Safely on Trusted Platforms takes center stage, this opening passage beckons readers with a casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

In today's digital age, shopping for car insurance quotes has become easier than ever. However, with the plethora of options available, it's essential to navigate this process safely on trusted platforms. This guide will provide valuable insights on how to shop for car insurance quotes securely while comparing prices effectively and understanding different coverage options.

Researching Car Insurance Quotes

When it comes to finding the best car insurance policy, researching and comparing quotes from different providers is crucial. This process can help you save money while ensuring you get the coverage that meets your needs. Here are some tips on how to effectively research and compare car insurance quotes:

The Importance of Comparing Quotes

- Comparing quotes allows you to see the range of prices offered by different insurance companies.

- You can identify potential discounts or special offers that may be available from certain providers.

- By comparing quotes, you can choose a policy that offers the best value for your specific needs and budget.

Tips for Researching and Comparing Quotes

- Obtain quotes from at least three different insurance providers to get a comprehensive view of your options.

- Make sure to provide accurate information when requesting quotes to receive the most accurate pricing.

- Consider the coverage limits, deductibles, and additional features offered by each policy when comparing quotes.

Key Factors to Consider

- Price: Compare premiums and discounts to find the most cost-effective option.

- Coverage: Evaluate the types of coverage included in each policy and choose one that meets your needs.

- Customer Service: Research the reputation of the insurance company for customer service and claims handling.

Benefits of Using Trusted Platforms

- Trusted platforms ensure the security of your personal information when requesting quotes online.

- You can access quotes from reputable insurance providers that have been vetted for reliability and quality.

- Using a trusted platform can streamline the quote comparison process and help you make an informed decision quickly.

Choosing Trusted Platforms

When shopping for car insurance quotes online, it is crucial to use trusted platforms to ensure the safety and security of your personal information. Here are some reputable websites or platforms that you can consider:

Reputable Websites for Shopping Car Insurance Quotes:

- 1. Insurance.com

- 2. Policygenius

- 3. The Zebra

- 4. Compare.com

Features that Make a Platform Trustworthy:

- 1. Secure Encryption: Look for platforms that use SSL encryption to protect your data.

- 2. Transparency: Trustworthy platforms provide clear information about their services and partners.

- 3. Customer Reviews: Check for reviews and ratings from other users to gauge the platform's credibility.

- 4. Licensing: Ensure that the platform is licensed to sell insurance in your state.

Steps to Verify the Credibility of a Platform:

-

1. Check for Contact Information

A trustworthy platform will have a valid physical address and contact information.

-

2

. Research the CompanyLook up reviews and ratings from independent sources to verify the platform's reputation.

-

3. Verify Licensing

Use your state's insurance department website to confirm the platform's licensing status.

-

4. Read Privacy Policies

Make sure the platform has a clear privacy policy outlining how your data will be used and protected.

Ensuring Safe Transactions

When shopping for car insurance quotes online, it is crucial to prioritize the security of your personal information. Ensuring safe transactions not only protects your sensitive data but also safeguards you from potential identity theft and fraud.

Identifying Secure Websites

- Look for HTTPS in the website's URL, indicating a secure connection with encryption to protect your data.

- Check for a padlock symbol in the address bar, showing that the site uses SSL/TLS encryption for secure communication.

- Avoid websites with suspicious pop-ups or requests for unnecessary personal information.

Reading Reviews and Feedback

- Research the platform's reputation by reading reviews from other users regarding their experience with security measures.

- Ensure the website has a privacy policy outlining how they handle and protect your data.

- Look for trust badges or certifications from reputable security companies to verify the platform's legitimacy.

Understanding Insurance Coverage

When it comes to car insurance, understanding the different types of coverage available is crucial in making informed decisions. It is essential to compare and contrast comprehensive and liability insurance options, considering the factors that influence the cost of insurance premiums.

Types of Car Insurance Coverage

- Liability Insurance: Provides coverage for damages and injuries you cause to others in an accident.

- Comprehensive Insurance: Covers damages to your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Collision Insurance: Pays for damages to your car in a collision with another vehicle or object.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if you are in an accident with a driver who has little to no insurance.

Comparing Comprehensive and Liability Insurance

- Comprehensive Insurance: Offers coverage for a wide range of incidents, including theft and natural disasters, beyond just accidents.

- Liability Insurance: Specifically covers damages and injuries you cause to others, not for damages to your own vehicle.

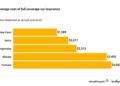

Factors Influencing Insurance Premiums

- Driving Record: A history of accidents or traffic violations can lead to higher premiums.

- Vehicle Type: The make, model, and age of your car can impact insurance costs.

- Location: Where you live and park your car can affect rates due to crime rates and traffic patterns.

- Coverage Limits: The amount of coverage you choose can impact the cost of premiums.

- Deductibles: Higher deductibles can lower premiums but require more out-of-pocket expenses in case of a claim.

Closure

In conclusion, shopping for car insurance quotes on trusted platforms is crucial in securing the best coverage for your vehicle. By following the tips and guidelines Artikeld in this guide, you can make informed decisions, ensuring a safe and reliable transaction process.

Stay informed, stay safe, and enjoy the peace of mind that comes with knowing you have the right car insurance coverage.

Top FAQs

Why is it important to compare quotes from different providers?

Comparing quotes allows you to find the best deal that suits your budget and coverage needs. It helps in understanding the range of options available in the market.

How can I identify secure websites for submitting sensitive data?

Look for HTTPS in the website URL, check for secure payment gateways, and read reviews about the platform's security measures.

What factors influence the cost of insurance premiums?

Factors such as age, driving history, type of vehicle, coverage amount, and location can impact insurance premiums.