As Progressive Commercial Auto Insurance: Cost vs Value takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

When it comes to protecting your commercial vehicles, understanding the balance between cost and value is crucial. This guide dives deep into the realm of Progressive Commercial Auto Insurance, shedding light on how different factors influence pricing and the benefits it brings to policyholders.

Cost of Progressive Commercial Auto Insurance

When it comes to Progressive Commercial Auto Insurance, the cost can vary based on several factors. Understanding what influences the cost can help you make an informed decision when choosing the right insurance for your business vehicles.Coverage levels and deductible amounts play a significant role in determining the cost of Progressive Commercial Auto Insurance.

Higher coverage levels and lower deductibles typically result in higher premiums, while lower coverage levels and higher deductibles can reduce your premium costs. It's essential to strike a balance between coverage and cost to ensure your business is adequately protected without overspending on insurance.

Factors Influencing Cost

- Driving history and experience of drivers

- Type of vehicles being insured

- Usage of vehicles (e.g., business purposes, mileage)

- Location of business operations

- Claims history and frequency

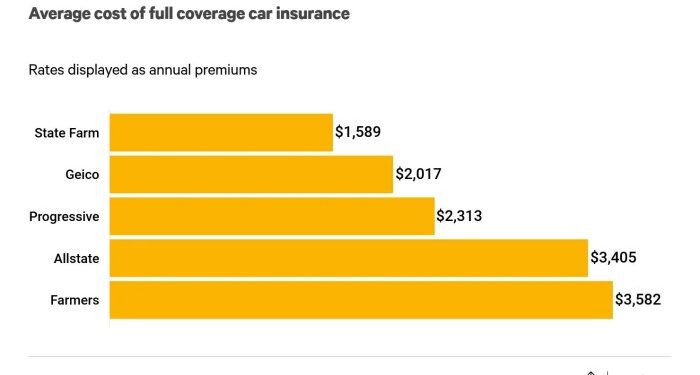

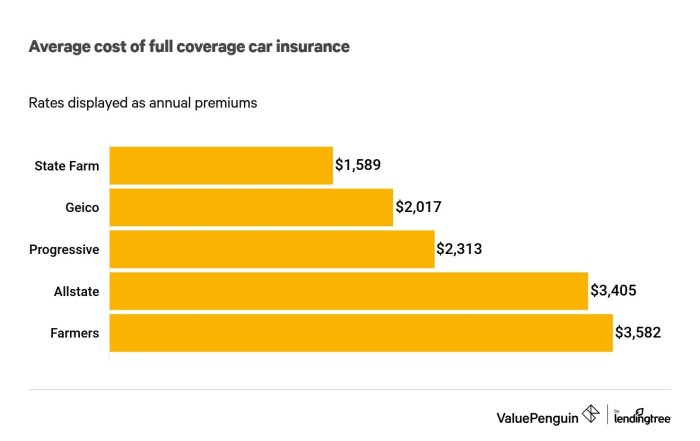

Comparison with Other Providers

When comparing the cost of Progressive Commercial Auto Insurance with other providers in the market, it's crucial to consider the coverage options, customer service, and reputation of the insurance companies. While Progressive may offer competitive rates for commercial auto insurance, other providers might have different discounts or incentives that could make them a more cost-effective choice for your business.

Value of Progressive Commercial Auto Insurance

Progressive Commercial Auto Insurance offers a range of benefits and value-added services to policyholders, ensuring comprehensive coverage and peace of mind.

Coverage Options

- Liability Coverage: Protects you in the event of an accident where you are at fault, covering bodily injury and property damage.

- Comprehensive Coverage: Provides protection against non-collision incidents such as theft, vandalism, or natural disasters.

- Collision Coverage: Covers the cost of repairs or replacement if your vehicle is damaged in a collision.

- Uninsured/Underinsured Motorist Coverage: Safeguards you in case of an accident with a driver who lacks insurance or sufficient coverage.

Value-Added Services

- 24/7 Claims Service: Quick and efficient claims processing to get you back on the road as soon as possible.

- Rental Reimbursement: Coverage for a rental vehicle while yours is being repaired after a covered accident.

- Roadside Assistance: Assistance for common roadside issues like flat tires, dead batteries, or towing.

Customer Testimonial: "Progressive Commercial Auto Insurance saved me time and money when I needed to file a claim after an accident. Their customer service was exceptional, and the process was hassle-free."

Cost vs Value Analysis

In analyzing the cost versus value of Progressive Commercial Auto Insurance, it is essential to compare it with its competitors to understand where it stands in the market.Progressive Commercial Auto Insurance offers a balance between competitive pricing and valuable coverage, customer service, and claims processing.

Let's delve deeper into how the cost aligns with the value it provides.

Comparison with Competitors

When comparing the cost of Progressive Commercial Auto Insurance with its competitors, it is evident that Progressive offers competitive rates while still providing comprehensive coverage. The value proposition of Progressive lies in its efficient claims process and excellent customer service, which adds to the overall value for policyholders.

Cost vs Value Breakdown

| Aspect | Progressive Commercial Auto Insurance | Competitor A | Competitor B |

|---|---|---|---|

| Premium Cost | Competitive pricing with various discounts | Higher premiums with limited discounts | Lower premiums but fewer coverage options |

| Coverage | Comprehensive coverage options tailored to business needs | Standard coverage with additional costs for customization | Basic coverage with limited add-ons |

| Customer Service | 24/7 customer support and online account management | Limited customer service hours and slower response times | Customer service through agents only |

| Claims Process | Efficient and streamlined claims process with quick resolutions | Lengthy claims process with multiple documentation requirements | Unclear claims process with delays in settlements |

Outcome Summary

In conclusion, Progressive Commercial Auto Insurance: Cost vs Value offers a comprehensive look at the intricacies of commercial auto insurance. From dissecting costs to evaluating the worth of coverage, this discussion equips readers with the knowledge needed to make informed decisions.

Questions and Answers

What factors influence the cost of Progressive Commercial Auto Insurance?

The cost is determined by various factors including coverage levels, deductible amounts, type of vehicle, driving history, and location.

What benefits does Progressive Commercial Auto Insurance offer?

Progressive offers benefits like roadside assistance, customized coverage options, competitive pricing, and a user-friendly claims process.

How does Progressive Commercial Auto Insurance compare to other providers in terms of cost?

Progressive's cost can vary depending on individual factors but is known for offering competitive rates compared to other providers in the market.