Exploring the ins and outs of Commercial Auto Policy: How to Avoid Coverage Gaps sets the stage for an informative journey ahead. Get ready to delve into the world of insurance with a focus on bridging those crucial coverage gaps.

Understanding Commercial Auto Policies

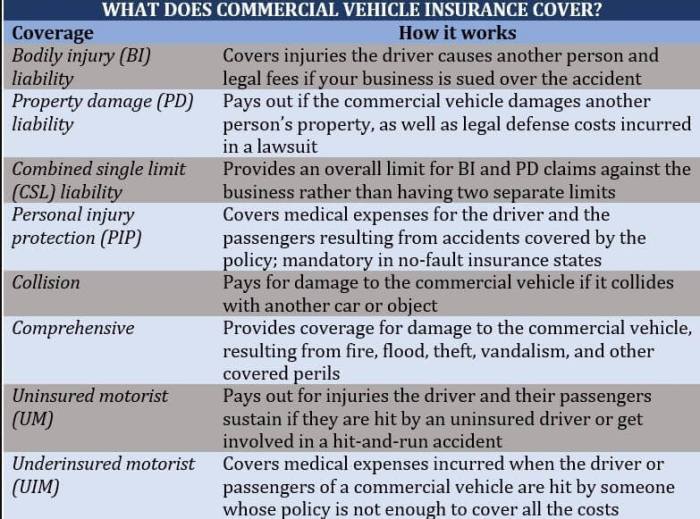

A commercial auto policy is a type of insurance that provides coverage for vehicles used for business purposes. This can include cars, trucks, vans, and other vehicles that are owned or operated by a business.

Types of Vehicles Covered

- Passenger vehicles: Cars and vans used for transporting employees, clients, or goods.

- Trucks: Box trucks, tow trucks, dump trucks, and other commercial trucks used for business operations.

- Specialized vehicles: Vehicles like food trucks, refrigerated trucks, and utility vehicles used for specific business purposes.

Key Features and Benefits

- Liability coverage: Protects the business from financial loss in case of an accident where the business is at fault.

- Physical damage coverage: Covers repairs or replacement of the vehicle in case of damage due to accidents, vandalism, or other incidents.

- Medical payments coverage: Helps pay for medical expenses for injuries sustained by drivers, passengers, or pedestrians in an accident involving the covered vehicle.

- Uninsured/underinsured motorist coverage: Provides protection if the business vehicle is involved in an accident with a driver who has insufficient insurance coverage.

Coverage Gaps in Commercial Auto Policies

When it comes to commercial auto insurance policies, it's crucial to be aware of potential coverage gaps that could leave your business vulnerable to financial risks.

Common Coverage Gaps

- Uninsured or underinsured drivers: If your policy doesn't include coverage for accidents involving uninsured or underinsured drivers, your business could be left to cover the costs.

- Hired and non-owned vehicles: Coverage for vehicles not owned by the business but used for work purposes may not be automatically included in a standard policy.

- Personal vehicle use: If employees use their personal vehicles for business purposes, there may be gaps in coverage if an accident occurs.

Risks Associated with Coverage Gaps

- Financial losses: Without adequate coverage, your business may have to pay out of pocket for damages, medical expenses, or legal fees resulting from accidents.

- Legal consequences: Failure to have the right coverage could lead to lawsuits, fines, or other legal actions that can impact the reputation and operations of your business.

Examples of Financial Losses

Imagine a scenario where one of your employees gets into an accident while driving their personal vehicle to make a delivery for your business. If your policy doesn't cover personal vehicle use for work purposes, you could be held liable for the damages, medical bills, and legal costs associated with the accident.

Strategies to Avoid Coverage Gaps

Ensuring that your business has adequate coverage in its commercial auto policy is crucial to avoid potential gaps in protection. By taking proactive steps and understanding policy exclusions and limitations, businesses can tailor their policies to meet their specific needs.

Review Policy Exclusions and Limitations

It is essential for businesses to carefully review their commercial auto policy to identify any exclusions or limitations that may leave them vulnerable to coverage gaps. By understanding what is not covered by the policy, businesses can take steps to address these gaps

- Regularly review policy documents to stay informed about any changes or updates.

- Consult with an insurance professional to clarify any confusing or ambiguous policy language.

- Consider purchasing additional coverage or endorsements to fill in any gaps identified during the review process.

Tailor Policies to Specific Needs

Businesses can mitigate coverage gaps by customizing their commercial auto policies to align with their unique operations and risks. By working closely with their insurance provider, businesses can ensure that their policy adequately protects them in various scenarios.

Customizing policy limits, deductibles, and coverage options can help businesses address specific areas of concern and prevent coverage gaps.

- Identify the types of vehicles used in the business and ensure they are accurately listed on the policy.

- Evaluate the geographical scope of operations and adjust coverage limits accordingly to avoid gaps in protection.

- Consider bundling commercial auto insurance with other business policies to streamline coverage and potentially save on costs.

Importance of Regular Policy Reviews

Regularly reviewing and updating commercial auto policies is crucial to ensure that businesses have adequate coverage and are protected from potential risks. Policy reviews help identify any coverage gaps, outdated information, or changes in business operations that may impact insurance needs.

Checklist for Policy Audit

- Evaluate the accuracy of vehicle information, including make, model, and VIN numbers.

- Assess coverage limits to ensure they align with the current value of vehicles and potential liabilities.

- Review driver information and ensure that all drivers are properly listed and covered under the policy.

- Check for any changes in business operations that may require adjustments to coverage types or limits.

- Verify that all endorsements and additional coverages are up to date and relevant to the business needs.

Role of Insurance Agents/Brokers

Insurance agents or brokers play a vital role in helping businesses navigate the complexities of commercial auto policies and identify potential coverage gaps. They can assist in conducting policy reviews, offer expert advice on coverage options, and recommend adjustments to ensure comprehensive protection.

By working closely with agents or brokers, businesses can proactively address any gaps in coverage and make informed decisions to safeguard their assets and operations.

Epilogue

In conclusion, ensuring your commercial auto policy is gap-free is vital for safeguarding your business. Stay informed, stay covered, and stay ahead in the realm of insurance policies.

Clarifying Questions

What are some common coverage gaps in commercial auto policies?

Common coverage gaps include personal vehicle usage, unreported vehicle modifications, and inadequate liability coverage.

How can businesses tailor their policies to prevent coverage gaps?

Businesses can tailor their policies by accurately listing all vehicles, specifying usage, and ensuring adequate coverage limits.

Why is it important to review policy exclusions and limitations?

Reviewing these helps businesses understand what is not covered and allows them to fill those gaps with additional coverage if needed.