Exploring the world of Building a Reliable Commercial Auto Policy Portfolio, this introduction sets the stage for a detailed analysis of how businesses can create a robust insurance portfolio to protect their assets.

In the following paragraphs, we will delve into key aspects such as policy diversification, risk assessment, and legal considerations, providing valuable insights for businesses looking to secure their commercial vehicles.

Understanding Commercial Auto Insurance

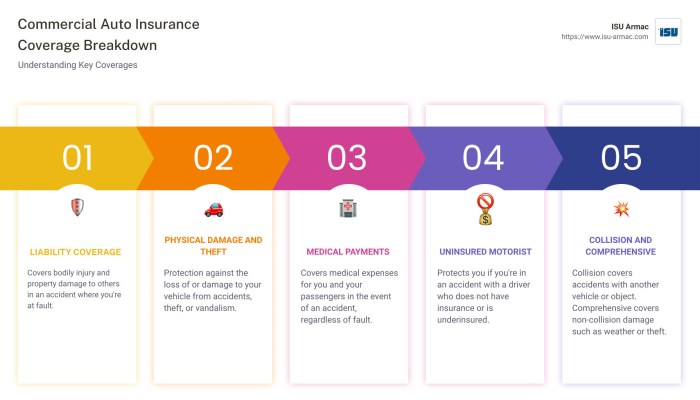

Commercial auto insurance plays a crucial role in protecting businesses and their vehicles from financial losses in case of accidents or other unforeseen events. It provides coverage for vehicles used for business purposes, offering a layer of protection that personal auto insurance does not provide.

Types of Vehicles Covered

- Delivery vans

- Trucks

- Taxis

- Limousines

- Company cars

Key Differences from Personal Auto Insurance

Commercial auto insurance differs from personal auto insurance in several key ways, such as:

- Higher liability limits to protect businesses from costly lawsuits

- Coverage for employees driving company vehicles

- Protection for business equipment and tools stored in the vehicle

- Specific coverage for various types of vehicles used for business purposes

Businesses Requiring Commercial Auto Insurance

- Commercial trucking companies

- Construction companies with work vehicles

- Distribution and delivery businesses

- Taxi and limousine services

- Any business that uses vehicles for work-related purposes

Building a Comprehensive Policy Portfolio

Insurance agents and brokers understand the importance of building a strong and diverse commercial auto policy portfolio. By offering a range of coverage options tailored to different businesses, they can better meet the unique needs of each client while maximizing their overall profitability.

The Importance of Diversifying a Commercial Auto Policy Portfolio

- Having a diverse portfolio helps mitigate risks by spreading coverage across different industries and business types.

- It allows agents to cater to a wider range of clients and attract more business opportunities.

- Diversification can also help stabilize revenue streams and protect against fluctuations in specific market sectors.

Assessing Insurance Needs of Different Businesses

- Conduct thorough assessments of each business to determine their specific risks and coverage requirements.

- Consider factors such as fleet size, types of vehicles, driver profiles, and industry regulations.

- Engage in detailed discussions with clients to understand their operations and potential liabilities.

Customizing Policies to Suit Specific Business Requirements

- Tailor coverage options based on the unique needs and risk profiles of each business.

- Offer endorsements or add-on coverages to address specific exposures that may not be covered by standard policies.

- Work closely with underwriters to create bespoke solutions that align with the client's operations.

Strategies for Optimizing Coverage While Managing Costs Effectively

- Explore package policies that combine multiple coverages to provide comprehensive protection at a competitive price.

- Review policies regularly to ensure they are up-to-date and reflect any changes in the client's business or industry.

- Leverage technology and data analytics to identify cost-saving opportunities and optimize coverage limits.

Risk Assessment and Mitigation

Risk assessment is a crucial part of managing commercial auto policies as it helps identify potential risks and vulnerabilities that may impact a business's operations. By understanding these risks, businesses can take proactive measures to mitigate them through policy adjustments and additional coverage.

Steps in Assessing Risks Associated with Commercial Auto Policies

- Conduct a comprehensive review of the business's operations and the nature of its commercial vehicles.

- Identify potential hazards such as driver behavior, vehicle maintenance, and external factors like road conditions.

- Analyze past claims data to pinpoint trends and areas of concern.

- Assess the potential financial impact of different risks on the business.

Common Risks Faced by Businesses with Commercial Vehicles

- Accidents leading to property damage or bodily injury.

- Theft or vandalism of commercial vehicles.

- Driver negligence or inadequate training.

- Regulatory compliance issues.

Methods for Mitigating Risks through Policy Adjustments and Additional Coverage

- Implementing driver safety programs and regular vehicle maintenance protocols.

- Adjusting policy limits and deductibles based on risk exposure.

- Adding specialized coverage for specific risks like cargo insurance or hired/non-owned auto coverage.

- Regularly reviewing and updating insurance policies to ensure adequate coverage.

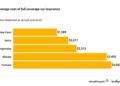

Impact of Risk Assessment on Policy Premiums

Risk assessment directly influences policy premiums as insurance providers calculate premiums based on the level of risk associated with insuring a business. Businesses with higher risks, such as a history of accidents or inadequate safety measures, are likely to face higher premiums.

On the other hand, businesses that demonstrate proactive risk management and mitigation strategies may be eligible for lower premiums as they pose a lower risk to the insurer.

Legal and Regulatory Considerations

When it comes to commercial auto insurance, understanding the legal requirements and regulatory standards is crucial to ensure compliance and protection. Let's delve into the key aspects to consider in this realm.

Legal Requirements for Commercial Auto Insurance

- All states in the U.S. have specific minimum requirements for commercial auto insurance coverage. This typically includes liability coverage to protect against bodily injury and property damage.

- Additionally, certain industries or types of vehicles may have specific insurance requirements beyond the standard liabilities.

Regulatory Influence on Policy Options

- Regulatory standards often dictate the types of coverage options available to commercial auto policyholders. Insurers must adhere to these standards when designing policies.

- Regulations can also impact the pricing and terms of commercial auto insurance policies, as they are set to ensure fair and equitable coverage for all parties involved.

Implications of Non-Compliance

- Failure to comply with insurance regulations can result in penalties, fines, or even legal action. It can also leave businesses vulnerable to financial losses in the event of an accident or claim.

- Non-compliance may also lead to the invalidation of insurance coverage, leaving the business exposed to significant risks and liabilities.

Staying Updated with Changing Laws and Regulations

- Given the dynamic nature of insurance laws and regulations, it is essential for businesses to stay informed and updated on any changes that may impact their commercial auto insurance policies.

- Working closely with insurance agents or legal advisors can help businesses navigate the complex landscape of insurance regulations and ensure compliance at all times.

Closure

In conclusion, Building a Reliable Commercial Auto Policy Portfolio is essential for businesses seeking comprehensive coverage and financial protection. By implementing the strategies discussed, businesses can navigate the complex landscape of commercial auto insurance with confidence and efficiency.

Questions and Answers

What types of vehicles are covered under a commercial auto policy?

Commercial auto policies typically cover vehicles used for business purposes, such as delivery vans, company cars, and trucks. Personal vehicles used for business may also require commercial coverage.

How can businesses optimize coverage while managing costs effectively?

Businesses can optimize coverage by assessing their specific needs, customizing policies accordingly, and exploring cost-saving strategies such as bundling insurance policies or adjusting coverage limits.

What are the common risks faced by businesses with commercial vehicles?

Common risks include accidents, theft, vandalism, and damage to vehicles or property. Businesses may also face liability risks if their vehicles are involved in accidents causing injury or property damage.